Editor’s Note: This article is a reprint of an investigative report that ran in the February 2019 issue of the Risk Retention Reporter. In April 2021, liquidation proceedings involving Spirit Commercial Auto Risk Retention Group were appealed to the Nevada Court. This article was cited in the Writ of Mandamus filed by Nevada Commissioner of Insurance Barbara Richardson. Given that, and the potential fallout the Spirit insolvency poses for both Spirit policyholders and third parties injured or killed by Spirit policyholders, this article is being republished.

As previously reported in the January 2019 issue of the Risk Retention Reporter, Spirit Commercial Auto Risk Retention Group, Inc. (Spirit Commercial RRG or the Company), a Nevada-domiciled RRG, refiled its 2017 annual statement on August 21, 2018. That revision took surplus for the Company in 2017 down to $703,088 from $13.4 million—a downward adjustment of $12.7 million—against $66.8 million in gross premiums written and $97.7 million in total liabilities. The company was left with a revised risk-based capital (RBC) ratio of 9.1%, far below the mandatory control level.* According to a letter filed by the Company with the restatement, Spirit Commercial RRG had also recently closed a loss portfolio transfer in excess of $100 million.

Given the size of the restatement and the fact that Spirit Commercial RRG is the second Nevada-domiciled RRG to run into RBC trouble in 2018, the Risk Retention Reporter decided to investigate the circumstances that led to the restatement. It quickly became clear that the 2017 restatement by Spirit Commercial RRG was the culmination of years of troubles and questionable practices at the company.

Though issues with Spirit Commercial RRG are evident as early as the final examination report for the Company as of December 31, 2013, there was marked escalation in the severity of the problems in 2018. The Risk Retention Reporter has seen a draft examination report for Spirit Commercial RRG as of December 31, 2016 that was dated February 22, 2018.

The examination report found that Spirit Commercial RRG had underrepresented loss reserves in 2016 by $26.9 million. With those additional losses considered, the report found that the Company had negative equity of $14.2M at the end of 2016. If the findings of the draft examination report are correct, the Company was insolvent as of December 31, 2016.

However, the report of examination as of December 31, 2016 was never submitted to the NAIC by the Nevada Division of Insurance (the Nevada Division or the Division), and no adjustments were made to Spirit Commercial RRG’s official filings, due to a request by the Division to extend the examination period into 2017. One of the examiners who worked on the report, then Assistant Chief Examiner for the Nevada Division of Insurance Renee Hanshaw, has since resigned. Hanshaw had no comment.

*Ed. Note: RBC is a tool regulators use to establish the minimum amount of capital an insurer needs based on the company’s size and risk profile. RBC allows regulators to take progressively larger regulatory actions as a company’s capital begins to approach the values established by the RBC formula.

Problems for Spirit Commercial RRG continued to mount when the Company’s auditor—William L. Shores, President of, and a CPA at, Shores, Tagman, Butler & Co. of Orlando, Florida—sent a letter, which the Risk Retention Reporter has also seen, dated May 23, 2018, that alleged quantified material misstatements at the Company in excess of $10 million. In addition to the quantified misstatements, the letter detailed misstatements that were not completely quantified and other items that might lead to material misstatement.

The letter would have been sent to the Division by early June 2018, at the latest. Towards the end of the letter, Shores, who had no comment and resigned from the Spirit Commercial RRG account in May 2018, noted provisions on the presentation of the letter to the Division.

“Proof must be provided to this firm that this information was provided to the Nevada Division. If proof is not provided to us by the end of five business days, we are bound by the provisions of the Nevada Administration Code to provide a copy of this letter to the Nevada Division. If we have not been provided proof of notification to the Department by May 30, 2018, we are obligated to send this letter to the Department,” wrote Shores in the letter.

The auditor’s letter was referenced in the letter Spirit Commercial RRG filed with the restatement of 2017 financials. The letter states “based on the Company’s former auditor’s allegations, the Nevada Division of Insurance is requiring the company to amend its December 31, 2017 yearend financial statement to address potential materially misstated financial items.”

The restatement by Spirit Commercial RRG considered all quantified material misstatements and some of the partially quantified material misstatements, essentially confirming the veracity of key portions of the auditor’s letter.

The letter also states that Shores’ firm believes that Spirit Commercial RRG’s loss reserves were materially understated, with Shores writing that “we find fallacies with both the assumptions and methodology utilized by the actuary. We believe that the assumptions and method- ology used by the actuary resulted in projected ultimate losses and resulting reserves which are substantially lower than they should be.”

Though Spirit Commercial RRG did not make any adjustments to loss reserves in the amended annual statement, the draft report of examination for the Company as of December 31, 2016 by the Division provides strong corroboration to the allegation of understated loss reserves in the auditor’s letter. And while these items were hanging over the Company—the draft examination report, the auditor’s letter, and impending restatement of the 2017 financials—the company was working to close a massive reinsurance deal.

In the months surrounding the closure of the loss portfolio transfer, there was an exodus from Spirit Commercial RRG. In June 2018, President Brenda Guffey left the company. Guffey signed a non-disclosure agreement when she left the company and was unable to comment. Then in July 2018, the Company’s captive manager Risk Services resigned from the account. Risk Services had no comment.

The loss portfolio reinsurance contract for the deal Spirit Commercial RRG closed—which the Risk Retention Reporter has also seen—was with Accredited Surety and Casualty Co., Inc. (the Reinsurer) a Florida-domiciled reinsurer under the Randall & Quilter Group (R&Q) umbrella. According to the document, the reinsurance contract was approved by the Nevada Division on August 7, 2018, more than two months after the auditor’s letter was sent to both Spirit Commercial RRG and the Nevada Division and nearly six months after the draft examination report. However, it is unclear if the Reinsurer or R&Q representatives were aware of the auditor’s letter, the draft examination report, or impending restatement. The Risk Retention Reporter was unable to reach the Reinsurer for comment, while R&Q had no comment.

The Nevada Division knew about serious solvency concerns at Spirit Commercial RRG in February 2018 and perhaps much sooner. However, the Company continued to write new business through much of 2018, as the Company’s certificate of authority was not suspended by the Division until October 19, 2018, though the Company claims it ceased writing new business in July 2018. Furthermore, the Division allowed the Company to pursue a loss portfolio transfer with financial documentation that appears to have been materially misstated. The Nevada Division had no comment.

The Man behind the RRG

In May 2014, the Risk Retention Reporter ran a piece on Spirit Commercial RRG and how premium growth at the Company was driving growth for the Transportation sector and risk retention groups as a whole. For the article, Spirit Commercial RRG’s then President Brenda Guffey was interviewed. At conferences later in 2014, and through email, numerous individuals in the industry stated that Spirit Commercial RRG was growing at a dangerous rate and headed for trouble. Numerous sources also noted that the individual that formed Spirit Commercial RRG had a prior risk retention group that had gone insolvent—that person was not Brenda Guffey, but Thomas Mulligan.

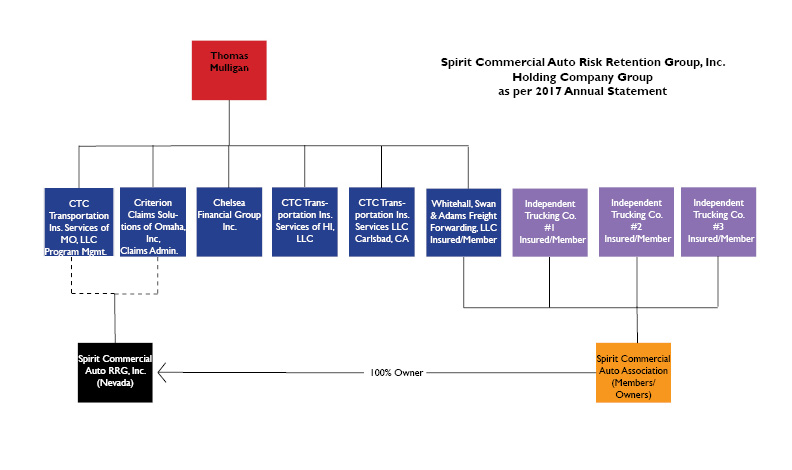

Thomas Mulligan’s name does not appear as a member of Spirit Commercial RRG’s board. Instead he exerts control over the Company through his position as Chairman and CEO of CTC Transportation Insurance Services, Inc. (CTC Transportation), the program manager for Spirit Commercial RRG. Mulligan tops the organizational chart for the Spirit Commercial RRG Holding Company Group.

In addition to CTC Transportation, Mulligan handles claims management for Spirit Commercial RRG through Criterion Claims Solutions of Omaha, Inc. which is a subsidiary of CTC Transportation. Mulligan also operates a premium finance company (Chelsea Financial) and a risk management company (10-4 Risk Management) that are subsidiaries of CTC Transportation and contracted to do business with Spirit Commercial RRG.

Additionally, Mulligan is 50% owner of Lexicon Insurance Management LLC the captive manager for the Company after the departure of Risk Services. Lexicon President Daniel George states that Lexicon is acting as captive manager for Spirit Commercial RRG in a temporary capacity. The Risk Retention Reporter was unable to reach another individual at CTC Transportation for comment.

Significant fees flow through CTC Transportation. In 2017, a year that Spirit Commercial RRG reported negative net income of $27.8 million, CTC Transportation billed $5.2 million in program management fees. This may not consider any fees generated by CTC Transportation through subsidiaries Chelsea Financial, 10-4 Risk Management, and Criterion Claims Solutions.

Mulligan has a history in the RRG industry, through his connection to Federal Motor Carriers Risk Retention Group, Inc., a Delaware-domiciled RRG that went insolvent in 2011. Spirit Commercial RRG began operation in 2012, a little more than a year after the insolvency proceedings for Federal Motor Carriers RRG began.

As with Spirit Commercial RRG, Mulligan’s name did not appear as an officer of Federal Motor Carriers RRG and once again his control over the RRG was exerted through a program management company, in this case CBIP Management, Inc. of New Jersey.

Multiple industry sources have stated that Mulligan was the main force behind Federal Motor Carriers RRG but were unable to go on the record due to contractual obligations. However, the Risk Retention Reporter has seen the feasibility study for Federal Motor Carriers RRG which corroborates Mulligan’s involvement at CBIP: “CBIP Management Inc. was born out of a ‘business relationship developed between Cold River Group, Inc. (CRG) and The Mulligan Insurance Agency, Inc. (MIA)’ and their respective principles Mr. Joseph Valuntas for CRG and Mr. Thomas Mulligan at MIA.”

According to court documents on the insolvency of Federal Motor Carriers RRG, the reasons for insolvency include projections on volume of business that “were woefully overstated,” a “management fee that was too high for a newly formed insurer,” and a business written that “had significantly higher risk potential than a newly formed insurer could bear.”

The Delaware Department of Insurance acted quickly to place Federal Motor Carriers RRG into liquidation. In Nevada, Mulligan has found an environment that allows him to reach higher volumes of premium. Federal Motor Carriers RRG saw premium peak at $14.2 million; Spirit Commercial RRG’s premium in 2017 was nearly five times higher at $66.7 million. However, many of the issues that led to the insolvency of Federal Motor Carriers RRG persist in Spirit Commercial RRG, including the high management fees and high-risk potential (as evidenced by negative net income of $27.8 million). Spirit Commercial RRG is Federal Motor Carriers RRG writ large.

Why it Matters

Risk retention groups remain a valuable tool that can be utilized to meet the needs of member insureds in innovative and effective ways. Risk retention groups are a key component of insurance programs at some of the most prestigious institutions in the country from the Harvard Medical Institutions, Inc. and Johns Hopkins University to prestigious law firms nationwide. The RRG vehicle can also cater to the unique needs of smaller member insureds unable to find adequate coverage elsewhere, as is the case with an RRG serving Hang Gliding and Paragliding Flights Schools or a different RRG meeting the insurance needs of CrossFit gyms.

Risk retention groups are regulated solely by their state of domicile. This gives risk retention groups the ability to quickly expand their operations from state to state and the flexibility to meet the specific needs of member/owners.

However, there can be financial risks in this expansion. Risk retention groups are unable to participate in guaranty funds, leaving no financial backstop for a RRG that becomes insolvent. As a result, regulators in the domiciliary state play a vital role in assuring the financial stability of RRGs and most RRG domiciles have done great work regulating their RRGs.

Spirit Commercial RRG is a large RRG, with over $60 million in premium. In 2017, the company wrote premium in all states outside of Delaware, the District of Columbia, Maine, Massachusetts, Michigan, New York, Rhode Island, and Wyoming. Some states have an outsized exposure, such as Illinois where Spirit Commercial RRG wrote $19.9 million in premium in 2017.

In terms of capital, the best-case scenario for Spirit Commercial RRG is surplus of $703,087 in 2017, a figure that is deficient given the $60 million in premium written by the Company that year. A sound insurer must be prepared for unexpected events, whether it is one large claim or an incidence rate that is higher than expected. Surplus is the protection against those events. With surplus of $703,087, Spirit Commercial RRG has left itself little to no room for error.

However, if the draft examination as of December 31, 2016 is accurate and the company had negative equity of $14.2 million in 2016, a figure that would have been further exacerbated by negative net income of $27.8 million in 2017, people could get hurt.

The insureds of the company, truckers and trucking companies, could be exposed to bankruptcy. However, third parties are also at risk. Individuals killed or maimed by a driver insured by Spirit Commercial RRG could find themselves with much less compensation than they would have otherwise received. Companies don’t find themselves in situations as severe as Spirit Commercial RRG’s overnight—the Company’s current troubles come after years of red flags.

Spirit Commercial RRG’s Explosive Entrance

2013 was a pivotal year for the risk retention group industry. The operational risk retention groups fell sharply, down to 250 from 261—still one of the largest yearly declines in active risk retention groups since the passage of the Liability Risk Retention Act. In the years since, the number of operational risk retention groups has continued to decline with the number falling to 219 to close out 2018, the lowest number of year-end operational RRGs since 2005.

Despite the decline in operational risk retention groups, premium for risk retention groups collectively increased by 3% in 2013, kicking off a trend in premium growth that would take collective RRG premium past $3 billion for the first time. The Transportation sector led premium growth in 2013, with gains that offset losses in the dominant Healthcare sector. And out in front of other Transportation RRGs, there was Spirit Commercial RRG.

The Risk Retention Reporter ran an article on Spirit RRG in the May 2014—”Spirit Commercial RRG Helps Drive Transportation Growth.” The article noted Spirit RRG’s explosive premium growth in its second year of operation, with premium increasing to $21.7 million from $5.9 million in 2012. In the article then President Brenda Guffey said that she anticipated that Spirit would continue to grow steadily but would “level off” after the explosive premium growth of the first two years. That didn’t happen.

Spirit Commercial RRG more than doubled its premium to $47.1 million in 2014. And after a flat 2015, Spirit Commercial RRG added another $18.4 million in premium in 2016 that took total premium for the RRG up to $63.7 million. Based on gross premiums written, Spirit Commercial RRG had become one of the ten largest operational RRGs. It had been operational for five years.

Seeing Red

Rapid premium growth can be a red flag for an insurance company. If the underwriting projections for an insurer experiencing rapid premium growth are off and claims come in at a higher than expected rate, the insurer could quickly find itself in hot water.

“A doubling of premiums written from one year to the next would trigger some financial ratios that would need investigating, and regulators would likely subject the insurer to heightened monitoring for financial solvency risk,” said Sandy Bigglestone, Director of Captive Insurance at the Vermont Department of Financial Regulation. “Depending on the business they are writing, the company may be subject to highly competitive price pressure to attract and retain members, so it may be more focused on growing membership with inadequate pricing (cash flow under- writing to bolster earnings), which would have the impact of weakening underwriting results. The impact of cash flow underwriting on underwriting results may actually take a few years to show up, which causes additional complications if the RRG has to increase rates or assess members to make up for significant underwriting losses. Typically, analysts will look for swings in gross or net premiums written greater than (+/-) 25% and for a change in premiums written for any line of business greater than (+/-) 33%.”

However, it’s not unheard of for a risk retention group to experience premium growth in excess of 100%. MedPro RRG Risk Retention Group cemented its position as top five RRG in terms of gross written premiums when it saw a premium increase of 142% that took premium up to $137.2 million. However, unlike Spirit Commercial RRG, MedPro RRG is sponsored by the Medical Protective Company and cedes most of its premium to its parent company. MedPro RRG also carries the rating of and is financially backstopped by its parent company.

So, when MedPro RRG posts negative net income of $634,571—one of MedPro RRGs worst years on a net income basis—it’s not an issue. However, severe losses such as the negative net income of $27.8 million reported by Spirit Commercial RRG in its amended 2017 annual statement to the NAIC are a cause for concern.

Red ink has been a feature of Spirit Commercial RRGs annual statement since the beginning, with the company reporting negative net incomes in each year of its operation. Some of those losses can be attributed to what was a soft Transportation market.

According to Robert Walling, a principal and consulting actuary at Pinnacle Actuarial Resources, the Transportation sector was soft two years ago, but has been “hardening since then.” Walling also noted that soft markets have historically led to an increase in insolvencies and whether an insurer can survive a soft market is dependent on “how much capital” the insurer has on hand.

Sean O’Donnell, Director of Financial Examination-Risk Finance Bureau at the District of Columbia Department of Insurance, Securities and Banking said that negative net income is “one of those case by case questions.” Factors such as capital contributions from members or high capital levels can offset concerns over negative net income. However, O’Donnell notes that “consistent (two or more years) of underwriting and net losses” can become a concern if the risk retention group had “thin capital to begin with.”

Spirit Commercial RRG’s reported negative income has varied over the years. In good years reported losses were minor. In bad years losses were much higher—see Spirit Commercial negative net income of $7.1M in 2014. Then there was 2017, where losses hit a calamitous $27.8 million. Was the Nevada Division aware of problems at the Company, and was anything done to right the course?

Looking Behind the Curtain: The 2013 and 2014 Final Examination Reports

The Nevada Division of Insurance conducted an examination of Spirit Commercial RRG as of December 31, 2013, and it is evident in the corresponding final examination report that there were already significant troubles at the Company.

The examiners found significant problems with Spirit Commercial RRG’s premium records, which were handled by the program manager CTC: “It was deter- mined that policyholder records, including payments, were co-mingled with other policyholders as well as payments being posted to incorrect policy years. As a result, some policyholders had large debt balances while others had large credit balances.”

The bookkeeping troubles of Spirit Commercial RRG run closely parallel to those of Federal Motor Carriers RRG. According to the liquidation documents for Federal Motor Carriers RRG the Receiver had trouble identifying recoveries from third parties due to “the inability of [Federal Motor Carriers RRG] to maintain proper business records.”

The final examination report as of December 31, 2013 also delves into developments at Spirit Commercial RRG since the filing of the 2013 annual statement. These are valuable, because there is often a window of 18 months between when an annual statement is filed and when the final examination report for the year in question is issued, basically one year to complete the examination and six months to write the report.

In the subsequent events section, the examiners compare the actual results of the company to the plan submitted, and the differences are glaring. The report notes that “the actual results of operations, as reported by Spirit, differ materially, and in the case of Premiums Written and Total Underwriting Expenses, by more than 500% from the projections provided to the [Nevada Division of Insurance].”

“A material level of differentiation from one reporting period to the next could be troublesome if not supported by a reasonable explanation and should be investigated,” said Bigglestone, when asked about significant differentiations from plans or projections submitted to a regulator. “Beyond a reasonable explanation caused by approved changes in a risk retention group’s plan of operation, if results trend toward potentially troubled company status, regulators should consult with the NAIC’s troubled company handbook and take appropriate actions, including but not limited to: immediate communications/meetings with the company and the elevation of reviews to monthly…If troubled company status is determined, the regulator should consider a cease and desist order, communication with other states, and potential orders for rehabilitation or liquidation.”

The examiners also discovered that the RBC report submitted by Spirit Commercial RRG for 2013 had three inaccuracies, and that “correction of these inaccuracies result in revised Total Adjusted Capital to be less than the authorized control level.” The examiners note that if the inaccuracies are corrected, Spirit Commercial RRG would have had capital that was just above the mandatory control level.

The final examination report for Spirit Commercial RRG as of December 31, 2013—issued in May 2015—seemed to have had an impact on the Company’s operation. That year the Company posted its only premium decline, with premium falling slightly to $45.3 million from $47.1 million.

Spirit Commercial RRG underwent another examination for the Company’s financial status as of December 31, 2014. The 2014 final examination report was far less critical, even providing some praise: “Spirit has made significant improvement in their premium billing and collection function.”

The examination team did adjust surplus for year end 2014 down to $1.9 million from $4.2 million due to “significant adverse development from 2013 and prior.” The 2014 final examination report for the Company was filed in March 2016—that year Spirit Commercial RRG’s gross written premiums increased by 40% to $63.7 million. The next examination conducted was the draft examination for the Company’s status as of December 31, 2016.

The Present

As of February 2019, Spirit Commercial RRG remains in runoff and the loss portfolio transfer between Spirit Commercial RRG and Accredited Surety and Casualty Company, Inc. is in effect. For members of the RRG and third parties, the loss portfolio transfer may be for the best. Given Spirit Commercial RRGs’ financial status after refiling their 2017 annual statement, there were real questions to whether the company had the capital to pay all outstanding and future claims.

However, it remains unclear how Spirit Commercial RRG can meet the requirements laid out in the final agreement with the Reinsurer. Under the agreement, Spirit Commercial is required to make an initial payment to the Reinsurer of $69.9 million within three days of closing. Then Spirit Commercial RRG is obligated to make monthly payments of $3.2 million to the Reinsurer for twelve months, for an additional total of $37.8 million.

Spirit Commercial RRG is no longer collecting premium. In the optimal scenario Spirit Commercial RRG has had surplus of $703,088 at the end of 2017. If the draft examination report as December 31, 2014 is accurate, and the Company had negative equity as early as 2016, there seem to be few avenues for the company to make payments.

Spirit Commercial RRG does, however, have a sister company. In 2016, Thomas Mulligan formed County Hall Insurance Company, Risk Retention Group (County Hall RRG) in North Carolina. Like Spirit Commercial RRG, County Hall RRG does business with CTC Transportation, Chelsea Financial, and Criterion Claims Solutions, among other companies under the CTC Transportation Umbrella.

County Hall RRG seems poised to surpass $20 million in gross written premiums in its third year of operation, a slower rate of growth than Spirit Commercial RRG, but still alarming. Furthermore, given that CTC Transportation is the holding company for both Spirit Commercial RRG and County Hall RRG, there is a possibility that Spirit Commercial RRG’s financial troubles could have an impact on County Hall RRG. Either way, it seems that Thomas Mulligan has already moved on to his next risk retention group.