Conference Recap

The 2021 National Risk Retention Association (NRRA) Conference was held from November 2 to 4 at the Sofitel Hotel in Chicago, Illinois. Although attendance was down from pre-COVID levels, there were indications that interest in the risk retention group vehicle is increasing.

Even with the decline in attendees, NRRA Executive Director Joe Deems was pleased with the conference.

“This turned out to be one of our best conferences in terms of overall satisfaction and enthusiasm among the attendees,” said Deems. “We learned this from other groups putting on their first in-person events this year, that because of ongoing governmental restrictions, travel bans by employers, and simply the persistent fear we see among potential attendees, that, while smaller numbers come out, the ones that do are highly motivated to participate. They are very excited to be with us and immensely enjoyed the content, presentations and personal contacts even more so than they normally would,” noting that audience participation was far more engaging and interactive than we normally see.

The sessions during the first day of the conference told a narrative on the history and future of the risk retention group vehicle. The conference kicked off with session that featured Risk Retention Reporter Managing Editor Christopher Diemel and Retired Morris Manning & Martin LLP Partner Robert “Skip” Myers, Jr. on the history of the risk retention group industry and the individuals who contributed to success of the RRG industry, particularly early leaders in the State of Vermont.

That session was followed by a panel moderated by Hylant Global Captive Solutions Leader Anne Marie Towle on why risk retention groups are great vehicles for insurance in the current market. The series was concluded by session titled “New and Changing Exposures: Should RRGs Lead or Follow” moderated by Pinnacle Actuarial Resources, Inc. Principal & Consulting Actuary Robert Walling on innovative coverages RRGs have begun to write and other coverages they may write in the future.

Another session at the NRRA conference that drew larger crowds was the “Regulators Update” that featured both domiciliary and non-domiciliary regulators of risk retention groups. The sessions focused on the progress that the NAIC Risk Retention Group Task Force has made over the past few years, including updating the risk retention group registration form and the issuance of new Best Practices and FAQs documents regarding risk retention groups.

Both the keynote speaker and the closing session tackled the topic of social inflation. Many carriers, particularly those in the Healthcare, saw a dip in both claim severity and claim volume due to the coronavirus pandemic. However, hardening in the market appears to have picked-up in 2021 suggesting that trends in social inflation will continue where they left off.

Numerous captive managers attending the conference told the Risk Retention Reporter that they have received more inquiries on the formation of new risk retention groups with many managers having new risk retention groups in the works. This activity is in addition to strong formations that have already occurred in 2021.

2021 RRG Formations

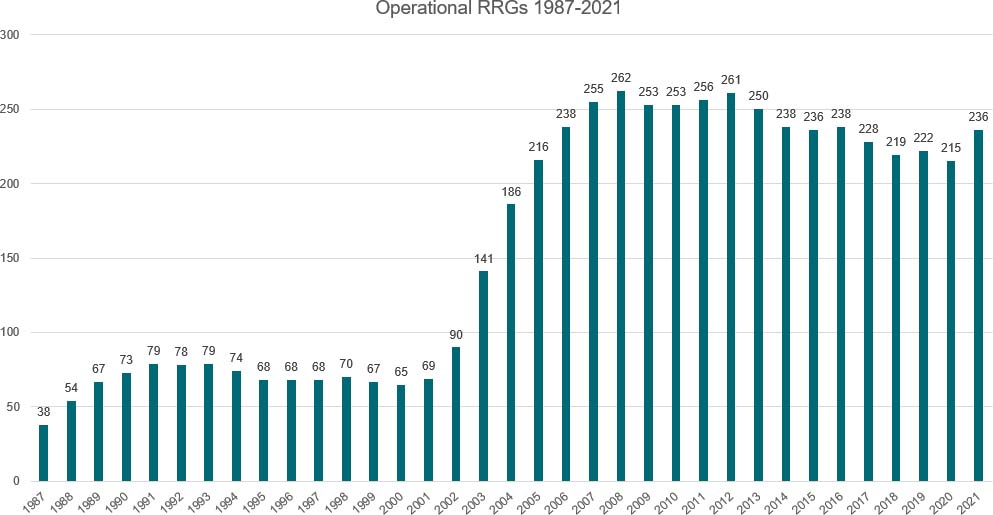

At the end of 2020 there were 215 active risk retention groups, the lowest number of operational RRGs since 2005. All the while, other types of captive formations were booming. It seemed that hard market that had begun in 2019 had left the risk retention group industry behind. That doesn’t appear to be the case anymore.

There have been 24 new risk retention group formations through November 2021, the largest number of new RRG formations since 2007. There was also one RRG reactivation, and just four RRG retirements, for a net increase of 21 operational risk retention groups in 2021. Although the industry got off to a slow start, the risk retention group industry now seems poised to recover from a difficult decade in the 2010s. The Healthcare industry led new formations in 2021 with ten new formations and one reactivation.

For more information on recent trends in risk retention group formations, including breakdowns by business sector and premium analysis, subscribe to the Risk Retention Reporter.