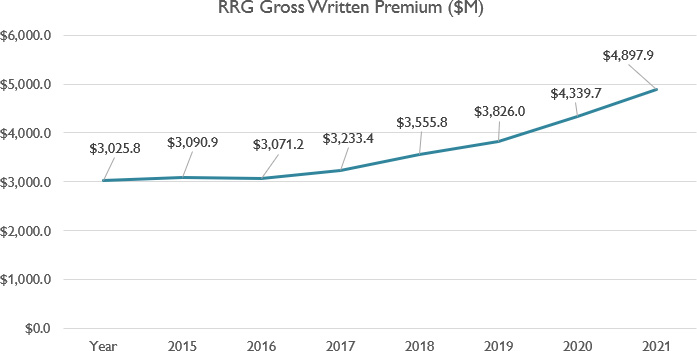

Risk retention groups reported record premium growth in 2022 with premium increasing by 12.9% to $4,897.9 million, an increase of $558.1 million over the $4339.7 million reported in 2021. This is the largest premium increase in dollar terms for the RRG industry, surpassing the premium growth of $527.0 million in 2003 and $519.3 million in 2021.

In contrast to 2003, when premium growth was driven by record risk retention group formations—58 new risk retention groups formed that year—premium growth in 2022 was primarily driven by established RRGs.

Mountain Laurel Risk Retention Group, Inc. saw the largest premium increase in dollar terms in 2022, with premium increasing by $101.5 million to $144.3 million, up from $42.8 million in 2021—an increase of 237 percent. Mountain Laurel RRG is an outlier in 2022 as its premium growth is largely the result of the merger of two RRGs.

In July of 2022, MLRRG member Thomas Jefferson University merged with the Albert Einstein Health Network. Prior to the merger, the Albert Einstein Health Network obtained coverage through its subsidiary insurer Broadline RRG, Inc. Broadline RRG was dissolved following the merger.

According to the 2022 Management Discussion and Analysis for Mountain Laurel RRG, the large increase in premium includes a novation of $76.8 million gross and $73.2 million ceded resulting from the merger of Albert Einstein Health Network with Thomas Jefferson University. As result, Mountain Laurel RRG was the sixth ranked RRG in terms of gross written premium in 2022.

In total, 162 risk retention groups reported premium gains, while 63 RRG reported premium declines. Of those RRGs reporting premium gains, fourteen saw increases of $10 million or greater. Risk retention groups with premium gains of $10 million or greater drove RRG premium growth in 2022 with that cohort reporting collective RRG premium growth of $470.4 million. Premium growth for RRGs reporting less than $10 million in premium growth was $268.2 million collectively.

This is an excerpt, for the complete article subscribe to the Risk Retention Reporter.