Besieged by pleas from business people and municipalities across the United States who were unable to obtain or afford liability insurance during the mid-1980’s, Congress responded by enacting amendments to the 1981 Product Liability Risk Retention Act. The new legislation, known as the Federal Liability Risk Retention Act of 1986 (LRRA), created two vehicles by which insurance buyers could more readily obtain liability insurance: risk retention groups (RRGs) and purchasing groups (PGs). This Guide compares and contrasts these two insurance vehicles, outlines the regulatory factors that make them attractive solutions, reviews the growth of the marketplace over the last three decades, provides steps on forming a risk retention group or purchasing group, and outlines the information that will let you decide if the vehicles are a good fit for your insurance needs.

RRGs and PGs Compared

According to the LRRA, a risk retention group must form as a liability insurance company under the laws of at least one state. The owners of the risk retention group must also be its insureds. Membership in the risk retention group is limited to persons engaged in similar businesses or activities with respect to the liability to which they are exposed. The LRRA requires the risk retention group to prepare a feasibility study or plan of operation which includes the coverages, deductibles, coverage limits, rates, and rating classification systems for each line of insurance the group intends to offer. The feasibility study or plan of operation must be filed with the risk retention group’s licensing state as well as with every state in which the entity intends to operate.

The LRRA requires a risk retention group to file annual financial statements with its chartering state and all other jurisdictions in which it is going to operate. Financial data submitted by the risk retention group must be certified by an independent public accountant and must include a statement of opinion on loss and loss adjustment expense reserves made by a member of the American Academy of Actuaries or a qualified loss reserve specialist.

It should be noted that risk retention groups are specifically exempted by the LRRA from participation in state guaranty funds; if a risk retention group becomes insolvent, insureds and claimants have no protection through such a fund. Similarly, purchasing groups insured by non-admitted carriers are not covered by state guaranty funds.

Unlike a risk retention group, a purchasing group is not an insurance company. Rather, a purchasing group can be any group of persons with similar or related liability risks who form an organization, one of whose purposes is to purchase liability insurance on a group basis. No specific requirements are imposed regarding the legal structure of a purchasing group. In the case of a trade association, a simple resolution of the board authorizing the organization’s officers to make arrangements to purchase liability insurance on a group basis would be sufficient to establish the purchasing group.

Like participants in risk retention groups, members of purchasing groups must be in similar or related businesses which expose them to similar liability risks. However, unlike risk retention group participants, purchasing group members need not concern themselves with raising capital or arranging reinsurance. Further, whereas risk retention groups typically must provide quality loss experience, have a minimum number of participants, a minimum premium volume, and the willingness to make a long-term commitment, purchasing groups may find these factors helpful to their formation, but not critical.

Purchasing groups are clearly much easier to form. They require no capital contributions, and although loss data is helpful to underwrite the risks, it is not essential. In addition, purchasing groups need not file feasibility studies, but can become operational upon the filing of a notice with their state of domicile and the other states in which the group intends to operate. The notice must state the name and domicile of the purchasing group, the lines and classes the purchasing group intends to buy, and the insurer from which the group intends to buy. While it may take as long as 18 months to form and qualify a risk retention group, a purchasing group can be up and running in 60 days.

Regulatory Issues

Over the past seventy years, with few exceptions, Congress has left regulation of the insurance industry to the states, each of which have their own requirements, including licensing laws, “seasoning” requirements, fictitious group laws, restrictions on the ability of insurers to offer to a group special terms regarding rates and coverages, higher tax rates on foreign (out of state) insurers, and countersignature laws.

To help promote the formation and multistate operation of group liability insurance programs, Congress enacted the Products Liability Risk Retention Act in 1981 and expanded its scope through amendments in 1986. With the advent of the 1986 Liability Risk Retention Act, counter-signature and fictitious group laws which had previously restricted formation of groups to purchase liability coverage were eliminated. Moreover, Congress prohibited discrimination against risk retention and purchasing groups by the states. It was Congress’s intent to enable businesses, professionals, nonprofit organizations and governmental agencies to establish self-insurance pools via the RRG vehicle or to purchase liability insurance on a group basis through a purchasing group.

On a practical level, preemption of state regulation for risk retention groups provides a particularly effective way for the company to commence operations. Assuming a risk retention group has obtained a license from its chartering state and has raised its capital, it can begin operations in other states almost immediately. The LRRA requires that a risk retention group that intends to operate in other states file its plan of operation or feasibility study. Non-domiciliary states can require that risk retention groups comply with specified state laws, such as unfair claims practices. Moreover, states can bring an action in state or federal court to enjoin a risk retention group if it deems the group to be in hazardous financial condition.

RRGs have the option of being regulated as traditional carriers or as captive insurance companies. In the early years after the LRRA, there were roughly equal numbers in each category but since the early 90s, captives have been the preferred form for the vast majority of RRGs. In addition, the number of captive domiciles has grown although Vermont remains the domicile of over a third of all RRGs.

For purchasing groups, preemption of state regulation works differently than for risk retention groups. The LRRA prohibits states from passing laws that would prohibit formation of purchasing groups. Moreover, the LRRA makes it unlawful for a state to prohibit an insurer from offering to provide advantages to the purchasing group or its members based on their loss and expense experience, not afforded to other persons with respect to rates, policy form, coverages, or other matters. Because purchasing groups are not risk bearers like risk retention groups, regulation of the purchasing group’s insurer is of equal importance to the overall operations and regulation of purchasing groups. As a general rule, admitted insurers of purchasing groups have greater regulatory flexibility, particularly on rate and form requirements, while purchasing groups insured by surplus lines carriers have the benefit of placements using non-resident surplus lines brokers.

Growth of the Risk Retention Marketplace

At the end of 2020, according to Risk Retention Reporter data, the number of risk operational risk retention groups was 214 and the number of operational purchasing groups was 1,024. The number of risk retention groups declined significantly during the soft market of the 2010s, with the number of operational groups falling from 261 in 2012 to 2014 as of the end of 2020. In contrast, the number of purchasing groups continued to increase through the soft market.

Despite the decline in the number of operational risk retention groups, RRG premium underwent significant growth in the 2010s, increasing from $2,536.5 million in 2010 to $3,574.7 in 2019. RRGs will likely see significant growth in 2020 as well due to the current hard market.

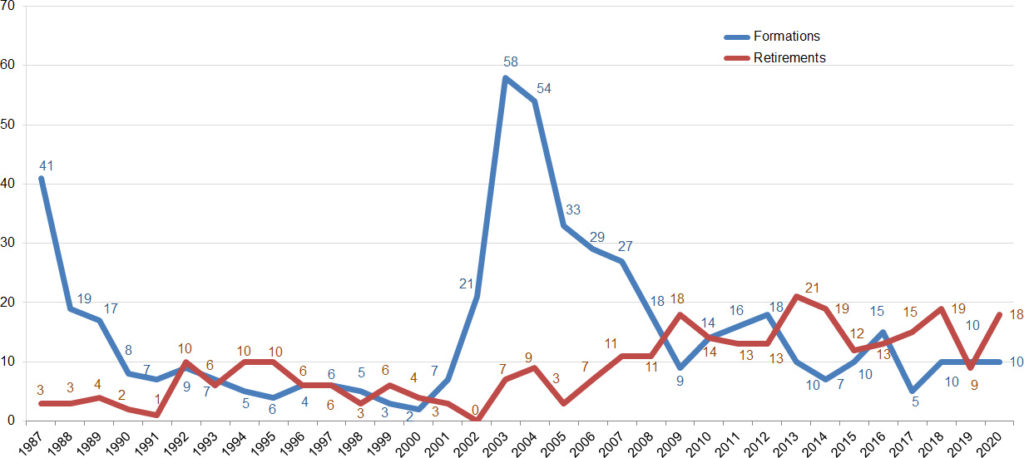

Historically, the number of operational risk retention groups has expanded during hard market periods, with the largest expansion occurring during the hard market of the mid-2000s when the number of operational risk retention groups increased from 65 in 2000 to 262 in 2008. During the height of the surge, in 2003 and 2004, over 50 new risk retention groups formed per year.

RRG Formations and Retirements: 1987 to 2020

The majority of the new formations in the 2000s were in the Healthcare sector and Healthcare RRGs currently represent 56% of operational risk retention groups and 57% of all RRG premium. And while RRGs account for a small part of the overall property/casualty marketplace, they have had a large impact on the Healthcare sector. In the 2010s, RRGs at times accounted for 15% of all medical liability premium nationwide, and in some states such as Pennsylvania and Massachusetts accounted for over 40% of the total medical liability premium.

However, it remains unclear if the risk retention group industry will see a significant expansion in the number of operational risk retention groups in the hard market of the 2020s.

The Healthcare sector, which drove growth in RRG numbers in the past, appears to be somewhat saturated due to both consolidation and the significant number of Healthcare RRGs currently operating. Other sectors, such as Transportation, have seen increased RRG activity in the 2010s, but growth in those sectors is unlikely to compensate for fewer RRG formations in the Healthcare sector.

Though the number of operational risk retention groups may not see a significant increase in the 2020s, the RRG industry will likely experience growth in market share due to premium growth at established risk retention groups.

Benefits of RRGs and PG

While the “liability” crisis served as the initial motivation for enactment of the LRRA, the fundamental advantages derived from risk retention groups and purchasing groups—from both economic and regulatory perspectives—are responsible for their continued success. In particular, the homogeneity requirement has enabled both RRGs and PGs to define strong risk management and loss control programs. Those loss control programs benefit from the expertise of their owner-insureds and the homogeneity of the risk they experience. Lack of access to state guaranty funds has not significantly impeded growth.

For risk retention groups, major benefits include the ability of members to control their own program; to obtain rate stability over the long-term; to implement effective loss control/risk management programs; to obtain dividends for good loss experience; to have access to reinsurance markets; and to maintain a stable source of liability coverage at affordable rates.

For purchasing groups, major benefits include the ability to negotiate tailor-made coverages at favorable rates with insurers. While for insurers, purchasing groups offer the ability to write profitable programs, while also lowering costs and increasing service to insurance buyers. For agents and brokers, purchasing groups offer an ideal way to expand a single-state program into a national program, and also to add value to the group through enhanced loss control and risk management programs.

Growth of the alternative risk transfer marketplace (or the captive insurance marketplace), of which risk retention groups and purchasing groups are a key part—is here to stay. The insurance departments in many state governments have added divisions devoted primarily to promoting and supporting captives. With a rapidly growing market share, captives provide a flexibility that traditional insurers cannot.

Forming an RRG or PG

Most RRGs forming as captives use captive managers licensed in the domicile in which the RRG forms to manage the formation and operation of the RRG. The first stage in forming an RRG is to conduct a feasibility study and the captive manager plays a key role in implementing that study. Selecting that captive manager is one of the most important decisions the RRG owners will make. The captive manager can also assist the RRG management in selecting other service providers for the RRG and reinsurance to limit the overall risk exposure of the RRG. However, the RRG owners retain many important responsibilities as described in the next section.

Forming a PG is less demanding than a RRG because the PG is not an insurance company and consequently is subject to less regulation. Many insurance professionals, including agents and brokers, can rapidly develop the expertise needed to form and operate a PG.

Under the LRRA, RRGs are regulated by the state in which they are licensed and free of most regulation in other states. Many of the responsibilities of running a small RRG can be delegated to captive managers and service providers. However, in recent years, the National Association of Insurance Commissioners (NAIC) established new governance standards with which RRGs must comply that apply to the operation of the RRG Boards. For information on risk retention group governance standards, see the article “How Regulators, Lawyers, and RRGs View the Governance Standards in Vermont.”

Future Developments

While the growth of the PG and RRGs marketplace has been impressive, several factors have hampered more vigorous expansion. A number of attempts have been made by the industry to amend the LRRA to address ambiguities and limitations which have deterred some potential RRG and PG formations but none of these has been successful. A particular challenge has been posed by certain non-domiciliary states which have used ambiguous or contradictory language in the LRRA to limit the expansion of RRGs and PGs in their states.

An amendment to the LRRA was introduced in the U.S. Congress on June 3, 2011. This amendment, the Risk Retention Modernization Act of 2011 (H.R. 2126), was similar to a bill introduced just over a year earlier. It sought to expand the scope of permissible coverage under the LRRA allowing risk retention groups and purchasing groups to write commercial property insurance, use the Office of Federal Insurance to oversee the federal preemption of non-domiciliary states’ regulation of RRGs and PGs; and set corporate governance standards for RRGs preempting any governance standards set under state laws. H.R.2126 never made it out of committee but there have been continued, more limited efforts, to allow risk retention groups to write property coverage.

As recently as January 2020 hearings were held at the Subcommittee on Housing, Community Development, and Insurance of the U.S. House Committee of Committee on Financial Services of the US House of Representatives on H.R. 4523 — Nonprofit Property Protection Act, a bill that would allow a small subset of RRGs to write property coverage. (See February 2020 Risk Retention Reporter)

Lacking new legislation, the risk retention industry, has taken to the courts and has been successful in attempts to establish key provisions under the LRRA. In April 2014, the US Second Court of Appeals held in Wadsworth v. Allied Professionals that the LRRA preempted a New York statute that allowed for direct action against RRGs. According to Circuit Court Judge Gerald Lunch “the federal Liability Risk Retention Act of 1986 contains sweeping preemption language that sharply limits the authority of risk retention groups chartered in another state.’

Since Wadsworth, advocates have notched additional wins at the Nebraska Supreme Court and at U.S. Ninth Circuit Court of Appeals, including the 2020 Allied Professionals v. Anglesey decision which upheld an RRG’s right to compel arbitration.