Florida Bill 516 (the Bill) was unanimously approved by the Committee on Banking and Insurance (Committee) of the Florida Senate at hearing held on March 22, 2023. The Bill would require risk retention groups writing commercial auto liability in Florida to carry a Financial Strength Rating of “A” or higher and be of a Financial Size Category (FSC) of VIII or above—$100+ million in policyholders’ surplus—from AM Best. The Bill was introduced by Committee Vice Chair and Florida Senator Nick DiCeglie.

While the Bill makes it explicit in Florida law that RRGs can write commercial auto liability, the bill as proposed would leave hundreds, if not thousands, of RRG members in the state without commercial auto liability.

The National Risk Retention Association (NRRA) and the National Council of Insurance Legislators (NCOIL) oppose the Bill as written. NRRA member American Contractors Insurance Group (ACIG)—through representative Robert Reyes—attended the March 22 hearing in support of the bill.

The Bill would also impose an AM Best rating requirement of A for surplus lines carriers writing commercial auto coverage in Florida. In contrast to RRGs, there is no FSC requirement for surplus lines carriers in the current Bill.

The next step for the bill is the Appropriations Committee on Criminal and Civil Justice at the Florida Senate. If passed, the law would go into effect on July 1, 2023.

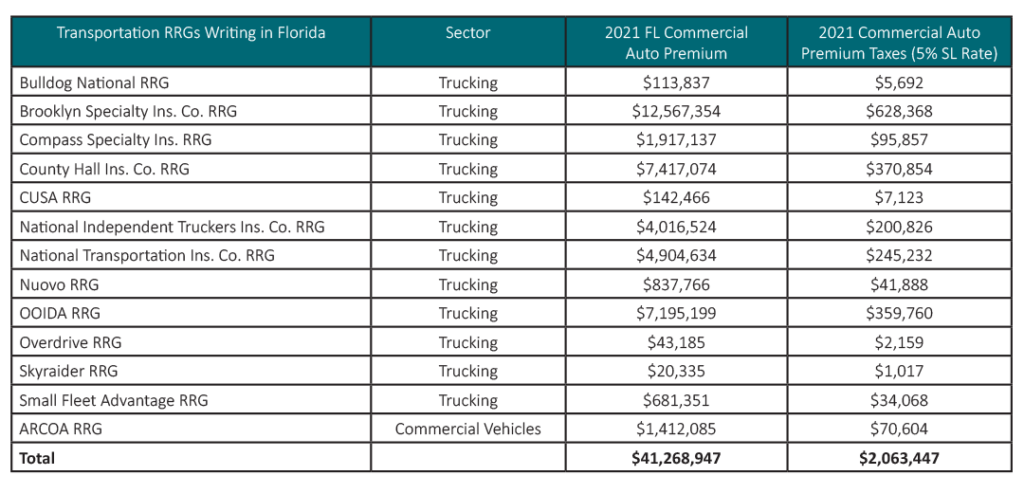

The Bill as composed would close the door for most risk retention groups writing commercial auto liability in Florida. As of 2021, the most recent year for which the Risk Retention Reporter has complete NAIC financial data, thirteen Transportation risk retention groups wrote commercial auto liability in Florida for a total of $41.3 million—10.2 percent of all commercial auto liability written by RRGs in 2021. Through those premium dollars Florida collected over $2 million in premium taxes.

Transportation RRG Commercial Auto Gross Written Premium in Florida and Resulting Florida Premium Tax

However, only one Transportation risk retention group operating in Florida carries an AM Best rating—National Independent Truckers Ins. Co., RRG (B++)—and none are of FSC VIII or above. Were the Bill to go into effect these risk retention groups would be barred from writing commercial auto liability in the state.

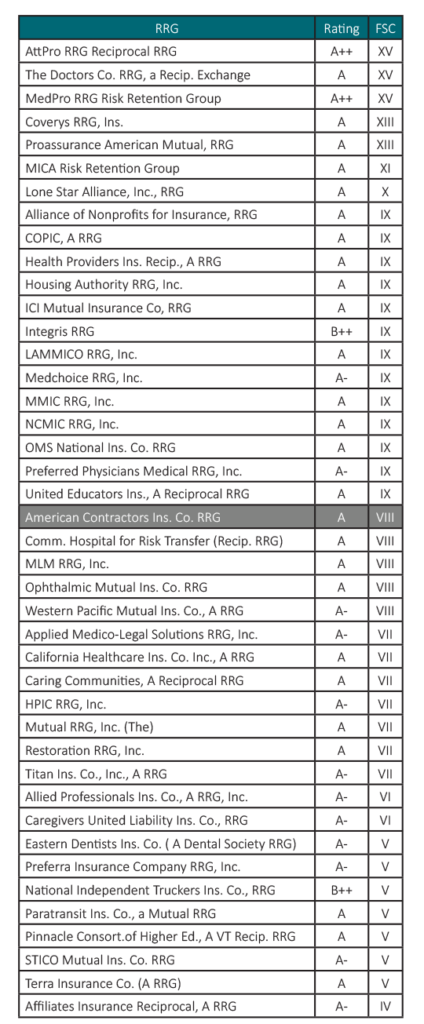

Very few risk retention groups across all business sectors meet the stringent requirements set forth in the Bill. There are only 25 risk retention groups rated by AM Best of FSC VIII or above, most of which are affiliated with other entities as is the case with MedPro RRG Risk Retention Group and The Doctors Company RRG, a Reciprocal Exchange. Of those, 21 carry a rating of A or better—less than 10 percent of operational risk retention groups.

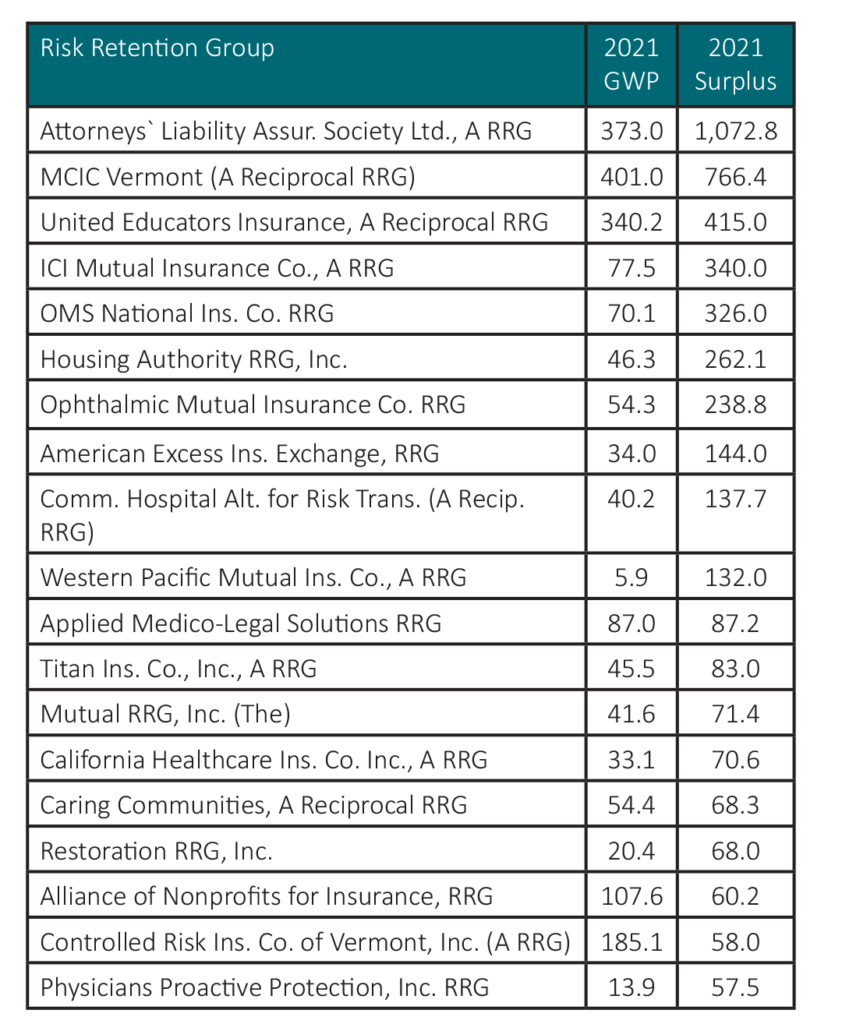

Top RRGs by Surplus 2021 ($M) with 2021 Gross Written Premium

An FSC of VIII or above requires surplus of $100 million or more, a figure that just ten risk retention groups reach, further stressing how the Bill as proposed primarily benefits those risk retention groups that are affiliated with larger entities.

Most of the groups that meet the requirements set forth by the Bill will see no benefit as they do not write commercial auto liability—there is a high Healthcare concentration amongst the largest RRGs. However, some well-established Transportation RRGs would be forced to stop writing commercial auto liability in Florida.

AM Best Rated RRGs with Financial Size Category (FSC)

One such group is OOIDA Risk Retention Group. Licensed in 1995, OOIDA RRG is the longest operating Transportation RRG providing commercial auto liability to truckers. OOIDA RRG has a nearly three-decade track record of success but does not carry a rating nor does it met the surplus requirements set forth in the Bill.

OOIDA Chief Operating Officer Rod Nofziger noted that since the RRG only insures members of the Owner-Operator Independent Drivers Association (OOIDA) and those members do not require their insurer to carry a rating, it doesn’t make sense for the RRG to obtain one. OOIDA currently insurers approximately 300 truckers in the State of Florida.

“Florida is already one of the most expensive states for truckers to obtain commercial auto coverage and RRGs provide critical competition in the state’s commercial auto market. Removing RRGs from that market would have a disastrous impact on all small business truckers in Florida, whether or not they insure through a risk retention group,” said Nofziger. “Considering the current realities of insurance markets down there, Florida’s lawmakers should be doing all they can to help RRG’s operate in their state, not hinder them. They owe it to the Floridians they were elected to represent.”

The Bill is supported by American Contractors Insurance Group (ACIG)—an entity that includes American Contractors Insurance Company Risk Retention Group (ACIC RRG). ACIG Chief Risk Officer Micah Bellow told the Risk Retention Reporter that members of ACIG are having difficulty getting the commercial auto components of their policies accepted in Florida, in part due to the following disclaimer that is present on the Florida OIR website and is required in all RRG policies:

“Notice, this policy is issued by your risk retention group. Your risk retention group may not be subject to all of the insurance laws and regulations of your state. State insurance insolvency guaranty funds are not available for your risk retention group.”

Bellow noted that ACIG was not aware of any other risk retention groups experiencing similar issues with getting their commercial auto policies accepted in the State of Florida. The Bill makes it clear that ACIC RRG can write commercial auto liability coverage in Florida, as it meets the requirements of an AM Best A rating and FSC VIII through partnership with its parent company ACIG.

Domiciled in Texas, ACIC RRG is one of the longest operating risk retention groups, having formed shortly after the passage of the Liability Risk Retention Act in 1987. ACIG and ACIC RRG serve construction companies operating throughout the Unites States.

Bellow stated that “ACIG supports changes to the bill put forward by NRRA and NCOIL and would support language that states that RRGs can write business in Florida.”

Bellow also noted that ACIG supports the Bill as it currently stands, as that version is the most likely to move forward in Florida and the bill is needed for ACIG members to continue to operate in the state. In 2022, ACIC RRG wrote direct premium of $4.7 million in Florida, of which $1.0 million was other commercial auto liability.

NRRA has expressed its intention to oppose the Bill if the changes it has proposed are not implemented. A March 10, 2023, letter by NRRA Executive Director Joseph Deems argues that the Bill as proposed both unlawfully discriminates against and unlawfully seeks to regulate risk retention groups. Deems argues that both those actions are “categorially preempted” by the Federal Liability Risk Retention Act.

NRRA put forth amendments to the bill that would remove the AM Best rating and size requirements and instead state that RRGs can provide commercial auto liability coverage to their members in the state.

Over the years there has been some confusion over whether risk retention groups can write commercial auto liability in Florida. A 1994 ruling—Mears Transportation Group v. State of Florida—effectively barred risk retention groups from writing commercial auto liability to for-hire vehicles such as taxicabs and limousines, as it requires vehicles in those industries to carry insurance backed by the Florida guaranty fund.

However, a May 25, 2012, letter from the General Counsel of the Florida Department of Motor Vehicles—which was attached to NRRA’s opposition letter to the Bill as proposed—stated that risk retention groups can write commercial auto coverage for their members in Florida, “so long as that policy does not extend to coverage for members who own or operate a taxicab, limousine, jitney, or any other for-hire passenger transportation vehicle.”

The May 25, 2012, letter specifically addressed whether Alliance of Nonprofits for Insurance, Risk Retention Group (ANI) could write commercial auto liability insurance for its members. ANI now insures nearly 1,000 nonprofits in the state of Florida and 98% of those nonprofits have at least one auto insured by ANI. The commercial auto coverages offered by risk retention groups extend beyond trucking and livery services.

“Although ANI is an AM Best A rated, FSC IX carrier and will not be impacted by this particular bill, it is clear RRGs play an important role in providing auto insurance to underserved sectors in Florida,” said ANI Founder, President, and CEO Pamela Davis. “The bill is discriminatory against RRGs. Regulators like to use scare tactics to disparage RRGs, but it’s high time to stop singling out RRGs and look into the mirror and recognize that companies fail because regulators fail to properly use the regulatory tools at their disposal.”

The Bill as composed would hold risk retention groups to a higher standard than authorized or admitted carriers writing commercial auto liability in Florida, as such entities are not required to carry an AM Best rating or to meet Financial Size Category requirements.

Deems noted that while ACIG is a member of NRRA, sometimes NRRA needs to act in opposition to a member to support the overall risk retention group industry.

“At the risk of oversimplification, initially I start here with the law of unintended consequences. It is true that one of our members supports the bill, having been frustrated by the negative “spin” put on risk retention groups in Florida and wanted to support legislation that would help them overcome that spin. After investigating all of this, however, I have formed the opinion that by no means is this support of the Bill motivated in any way to hurt RRGs or the industry,” said Deems. “Rather, the second and most important part of my opinion here is that the much more significant forces behind this Bill are the insurance industry lobbyists who have gone beyond the “spin” to rely upon uneducated, inaccurate and misleading information, which will undoubtedly help them with their other clientele. In fact, if our member were to withdraw from its support of this bill, I believe the lobbyists likely would keep the bill going. In short, I have confidence that the Senate and its legal staff will be able to delve through all of this to get to the truth about RRGs and their importance to the economy of the State of Florida.”

NCOIL primarily opposes the Bill due to the requirement that an RRG carry AM Best rating specifically, as the bill undermines “the spirit and intent of competition among rating agencies.”

“As currently written, the law fails to recognize the eight NRSROs [nationally recognized statistical rating organization] registered with the SEC Office of Credit Ratings in the classification of insurance companies,” said Demotech President Joseph Petrelli. “The Bill furthers a functional monopoly.”

The Bill is moving quickly through the Florida Senate and NRRA believes that if passed the Bill would be signed into law by Florida Governor Ron DeSantis.

If you found this article informative, subscribe to the Risk Retention Reporter.